Well - that's a lot a trading for a pretty small profit. Needless to say I am disappointed. Again, I find myself second guessing the amount of risk being taken as well as the amount of testing done before cutting loose a chart to run with real money. I am going to make some chart changes for April - starting tomorrow and then do it all again.

20 He replied, “Because you have so little faith. Truly I tell you, if you have faith as small as a mustard seed, you can say to this mountain, ‘Move from here to there,’ and it will move. Nothing will be impossible for you.” [21] [a] Matthew 17:20-21

Tuesday, March 31, 2015

03-31-2015 Results

March is done. Profitable, but not nearly what it should have been. Too many mistakes. I'm gonna try some different ideas in April to see if I can get more consistent winning days - either way, its gonna be a wild ride.

Today's Action:

Small winner on the S&P

A really ugly 6:27 Russell chart

A nice winner on the "Version 2" 7:30 Russell chart

A decent winner also on the original 7:30 Russell chart

Today's Action:

Small winner on the S&P

A really ugly 6:27 Russell chart

A nice winner on the "Version 2" 7:30 Russell chart

A decent winner also on the original 7:30 Russell chart

Monday, March 30, 2015

03-30-2015 Results

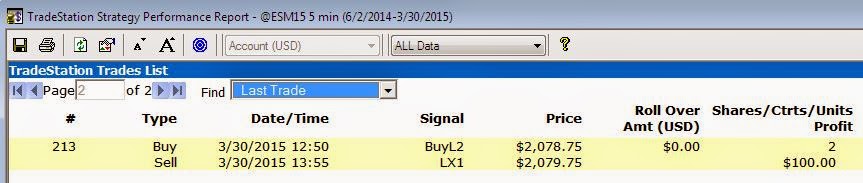

The market moved - only the systems were totally out of sync today - just an ugly day. Also, I did not trade the 11:30 Russell chart - I will watch it for a while before turning it back on - if ever.

Today's Results:

The"Big" winner of the day

yuk

again

again

Today's Results:

The"Big" winner of the day

yuk

again

again

Friday, March 27, 2015

03-27-2015 - Portfolio Weekly Results

It was a strange and wild week. There are still 2 days left in March and I still expect a large move in the markets to end the first quarter of 2015 - So I'm expecting a wild ride again at least at the start of the week.

The Portfolio lost $100 this week

So far in March, the portfolio has produced $5145 in profits

Since inception on January 6th, the portfolio has produced a profit of $16064.25

Several interesting facts

1) The original 7:30 Russell chart was switched off on 3/9/2015 after several stop losses in a row. Had I kept running it, it would have produced $6860 between 3/9 and 3/24 - Bummer!

2) The Nasdaq chart just didn't work out - Actually most of them don't - I've been pretty fortunate in that regard. I won't be running another Nasdaq chart until I can test much more

3) It appears that the biggest issue affecting my overall returns is me. Individually, each system made more money than what I was able to capture - because I made several changes during the month - changing the number of contracts then losing big then reducing contracts and winning small. I am learning that the plan needs to be more spread out - maybe monthly - then "Dance with the one you brung" for the month without changing them.

I will post another Portfolio update on Tuesday that covers the entire month of March.

Have a great weekend!

The Portfolio lost $100 this week

So far in March, the portfolio has produced $5145 in profits

Since inception on January 6th, the portfolio has produced a profit of $16064.25

Several interesting facts

1) The original 7:30 Russell chart was switched off on 3/9/2015 after several stop losses in a row. Had I kept running it, it would have produced $6860 between 3/9 and 3/24 - Bummer!

2) The Nasdaq chart just didn't work out - Actually most of them don't - I've been pretty fortunate in that regard. I won't be running another Nasdaq chart until I can test much more

3) It appears that the biggest issue affecting my overall returns is me. Individually, each system made more money than what I was able to capture - because I made several changes during the month - changing the number of contracts then losing big then reducing contracts and winning small. I am learning that the plan needs to be more spread out - maybe monthly - then "Dance with the one you brung" for the month without changing them.

I will post another Portfolio update on Tuesday that covers the entire month of March.

Have a great weekend!

03-27-2015 Results

It started out just fine, but one big stop loss can mess up an otherwise really good day - all in all, I was happy to survive this crazy week without losing my skin.

I will post the weekly results a bit later...

Today's Action:

This is an updated version of the 11:15 S&P chart - kinda breakeven for the day

The 6:27 Russell chart continues to perform well

The 7:30 version 2 Russell chart did very well today - although the amount shown here is not accurate - the actual profit was about 800 - that's what I will record in the log

The original 7:30 Russell had a very small winner

The ugly duckling today was the 11:15 Russell chart with a stop loss

I will post the weekly results a bit later...

Today's Action:

This is an updated version of the 11:15 S&P chart - kinda breakeven for the day

The 6:27 Russell chart continues to perform well

The 7:30 version 2 Russell chart did very well today - although the amount shown here is not accurate - the actual profit was about 800 - that's what I will record in the log

The original 7:30 Russell had a very small winner

The ugly duckling today was the 11:15 Russell chart with a stop loss

Thursday, March 26, 2015

03-26-2015 Results

What a wild ride!... After crying in my dinner last night and thinking it all out, I decided to leave the systems alone and trade them exactly the same way today. The systems all made money except for a small loss on the S&P chart and more than made up for yesterday's disaster. There are still 3 days left in the trading month - which is the end of the first Quarter of 2015. I would expect the market to finish much higher by the end of the quarter - let's find out.

Today's Action:

The only loser of the day - it was up over 300 before muddling around for a small loss with 2 contracts

The 6:27 Russell chart worked exactly as designed today - very quick in and out with 3 contracts

Nice trade on the 7:30 "Version 2" with 5 contracts - the big winner of the day

This is the original 7:30 Russell with 1 contract - we are just starting to make friends again

The 11:15 Russell did very well today - almost perfect - with 2 contracts

Today's Action:

The only loser of the day - it was up over 300 before muddling around for a small loss with 2 contracts

The 6:27 Russell chart worked exactly as designed today - very quick in and out with 3 contracts

Nice trade on the 7:30 "Version 2" with 5 contracts - the big winner of the day

This is the original 7:30 Russell with 1 contract - we are just starting to make friends again

The 11:15 Russell did very well today - almost perfect - with 2 contracts

Wednesday, March 25, 2015

03-25-2015 Results

Easy come, easy go. The market giveth and the market taketh away. Anyone who thinks this is easy is wrong. Anyone who thinks that automated trading takes all the emotions out of trading is wrong. As bad as today was, none of these systems are doing anything that they have not done during the backtest. The best course of action after a bad day is to ride out the storm... just like a racer on a track with a big crash in front of him.... just drive through it.

Also worth mentioning - just because its a good story - is the original 7:30 Russell chart that made most of the big money in January was turned off on March 9th because of a little ugly pullback consisting of 3 stop losses in a row - it seemed like the sky was falling... well that chart has had a good winning trade for the past 12 days since it was turned off. I have been watching it make play money the entire time - thinking that as soon as I turn it on it will lose - and that's exactly what happened - I'm only running it with one contract for now, but it's staying on this time (I think).

Today's Action:

The S&P chart had no chance - the market had been killed by news - stop loss

The 6:27 Russell chart was the big winner of the day

This is the newer 7:30 Russell chart - trading 5 contracts - ugly

The is the original 7:30 Russell chart on its first day back - peachy

In the big scheme of things this is a small loss on the 11:15 Russell

Also worth mentioning - just because its a good story - is the original 7:30 Russell chart that made most of the big money in January was turned off on March 9th because of a little ugly pullback consisting of 3 stop losses in a row - it seemed like the sky was falling... well that chart has had a good winning trade for the past 12 days since it was turned off. I have been watching it make play money the entire time - thinking that as soon as I turn it on it will lose - and that's exactly what happened - I'm only running it with one contract for now, but it's staying on this time (I think).

Today's Action:

The S&P chart had no chance - the market had been killed by news - stop loss

The 6:27 Russell chart was the big winner of the day

This is the newer 7:30 Russell chart - trading 5 contracts - ugly

The is the original 7:30 Russell chart on its first day back - peachy

In the big scheme of things this is a small loss on the 11:15 Russell

Tuesday, March 24, 2015

03-24-2015 Results

A rough day in the market - lazy sideways action until a fall near the end of the day which just happened to be in the wrong direction for the systems

Today's Action:

Just a bad trade on the S&P - nothing else to say

The 6:27 Russell chart took a small winner - trading 3 contracts

The 7:30 Russell chart had a very small winner - now with 5 contracts - it got out just before the move of the day

The 11:15 Russell chart just had the direction wrong today - stop loss

Today's Action:

Just a bad trade on the S&P - nothing else to say

The 6:27 Russell chart took a small winner - trading 3 contracts

The 7:30 Russell chart had a very small winner - now with 5 contracts - it got out just before the move of the day

The 11:15 Russell chart just had the direction wrong today - stop loss

Subscribe to:

Comments (Atom)