Assuming a starting account of 15K, the $9948 profit in January represents a monthly gain of 61%.

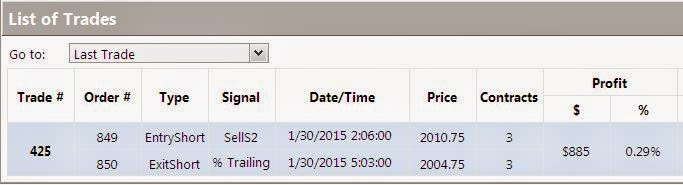

Here are the stats:

The Portfolio started on January 6, 2015 with 2 charts, then added a 3rd on January 9, added a 4th on January 28, and a 5th on January 30th

The Portfolio generated a loss of -$4921.75 this week

The Portfolio has generated $9948 in 19 trading days, which is an average $523 per trading day

In 19 trading days, there have been 6 losing days, the largest being -$2512.50

In 19 trading days, there have been 13 winning days, the largest being $3557.50

There have been no days where all charts were losers

There have been 9 days where all charts were winners (or didn't trade)

The Early S&P 5 minute chart started the month doing well, but ultimately cost me on the last week with 3 stop losses (-$4500). It would have been wise for me to turn it off - lesson learned.

Also noteworthy is that I started the system live on January 6th. Had I had the system running on the first two available trading days (January 2nd and 5th), it would have been a winner on both days according to the back-test, adding a couple thousand more to the winnings for the month.

All of this trading has happened while I have been at work or sleeping - no hands.

The spreadsheet is getting a bit wide... I have several new charts that may get added in February.

Gonna do it all again in February -

Have a nice weekend!