Well - January trading is over. It started well but finished kinda ugly. The month was profitable - I'll post the weekly/monthly totals later tonight - but the last week really put a dent in an otherwise great run.

I had written of my concern about the early S&P system and how the risk of a losing streak with that big stop loss was probably more that I should be taking... and I was right. I should have switched to the 3 minute chart which has been doing better (and has a smaller stop loss number). I had another small technical issue on the Russell 2k that cost me money today - I'll describe it below. The Dow chart did not trade today.

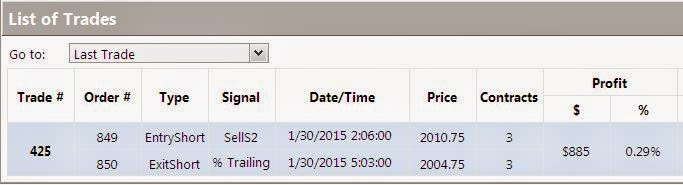

Today's Action:

The early S&P system burned me with that big stop loss. As I feared, a few of these in a row really did me in this week. The chart just below is a 3 minute version that I ran today as well. I will be turning off the 5 minute chart.

The 3 minute early S&P did much better and offset some of the loss from the 5 minute chart. I will think about running this every day from now on.

The Russell chart had a rejected order this morning to go short... instead it went long... I'm still investigating why. Had it gone short it was a $2500 winner today.

The bonds chart was volatile today - stopped out for a small loss.

No comments:

Post a Comment